What is a Credit Score?

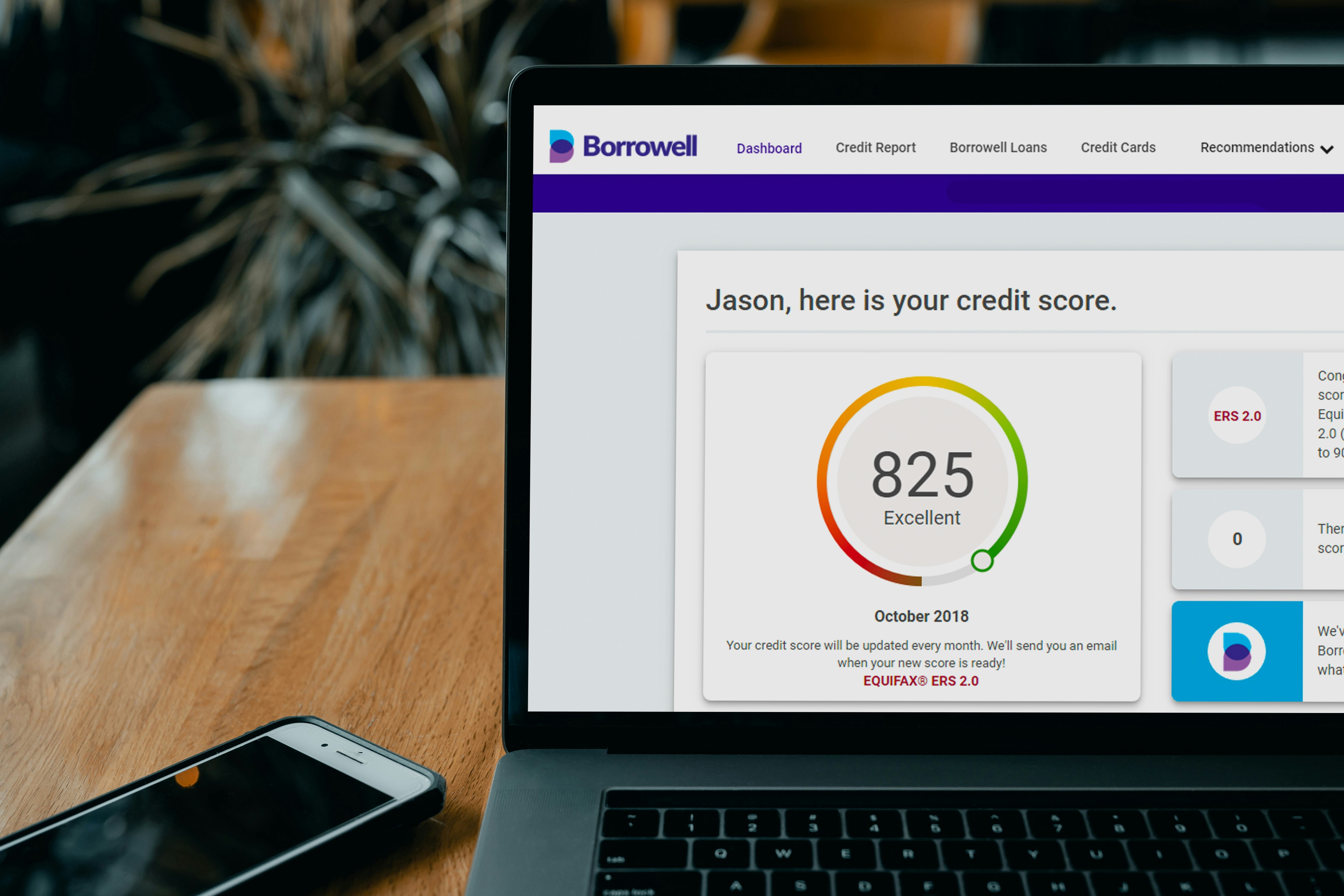

A credit score is a numerical representation of an individual’s creditworthiness, determined by evaluating their credit history and financial behavior. This score plays a crucial role in various financial decisions, impacting the ability to secure loans, credit cards, and favorable interest rates. Credit scores typically range from 300 to 850, with higher scores indicating better credit risk. Generally, a credit score above 700 is considered good, while scores below 600 may hinder access to credit facilities.

Credit scores are calculated using various scoring models, the most commonly used being the FICO Score and VantageScore. These models utilize different algorithms, but they generally assess similar factors. The primary components impacting a credit score include payment history, credit utilization, length of credit history, types of credit used, and new credit inquiries. Each of these factors contributes differently to the overall score, highlighting the importance of maintaining a healthy credit profile.

Payment history is the most significant factor, accounting for approximately 35% of the total score. It reflects the consistency of timely bill payments. Credit utilization, which is calculated by dividing the total credit card balances by the total credit limits, represents about 30% of the score. It shows how much of the available credit is being utilized. The length of credit history contributes about 15% to the score, as longer credit histories usually demonstrate more reliability. Types of credit used, including credit cards, retail accounts, and loans, make up 10%, while new credit inquiries account for the remaining 10%. This overall structure indicates that a comprehensive understanding of these elements is essential for managing credit scores effectively.

The Importance of Credit Scores

Credit scores serve as a crucial measure of an individual’s financial health and influence a wide array of financial decisions. A credit score is a numerical representation of one’s creditworthiness, calculated based on credit history, including payment history, amounts owed, length of credit history, new credit, and types of credit used. Because of this, credit scores play a critical role in determining loan approvals. Lenders use credit scores to evaluate the risk of lending money or extending credit to individuals. A higher credit score generally leads to favorable loan approval terms, while a lower score can result in rejection or higher interest rates.

Interest rates on mortgages and credit cards are significantly impacted by credit scores as well. Individuals with higher credit scores are often offered lower interest rates, ultimately saving them money over the life of a loan or credit account. Conversely, those with lower credit scores may face significantly higher rates, leading to increased overall financial burdens. Moreover, when it comes to rental applications, landlords frequently review credit scores as part of their tenant screening process. A strong credit history can enhance the chances of securing a rental agreement, while a poor credit score may hinder such opportunities.

Additionally, credit scores influence insurance premiums. Insurers often assess an individual’s credit history when determining the cost of premiums for auto, home, and other types of insurance. Thus, maintaining a good credit score can lead to reduced rates on insurance policies, further underscoring the significance of a healthy credit score in managing overall financial responsibilities. In conclusion, credit scores are an essential component in navigating personal finance, unlocking opportunities for better access to financial products and services while ensuring more favorable terms and conditions.

How to Improve Your Credit Score

Improving your credit score is a crucial step towards achieving better financial health and accessing favorable loan terms. One of the most essential strategies is to ensure that all bills are paid on time. Payment history significantly impacts your credit score, making it vital to establish reminders or automatic payments to avoid late fees. Consistently paying bills on time demonstrates reliability to creditors and positively influences your credit profile.

Another effective method for enhancing your credit score is to reduce outstanding debt. High credit utilization—using a significant portion of your available credit—can adversely affect your score. Aim to keep your credit utilization ratio below 30%. Prioritizing debt repayment, particularly on high-interest credit cards and loans, can boost your creditworthiness while reducing financial strain.

It is also beneficial to avoid making new credit inquiries unless necessary, as each application can slightly impact your credit score. Each hard inquiry stays on your report for approximately two years, and lenders may view multiple inquiries as a sign of financial distress. Consequently, it is prudent to space out applications for new credit.

Equally important is the regular review of your credit reports for errors. Errors can occur from a variety of sources, such as identity theft or incorrect account information. Annual credit report checks from the major credit bureaus—Equifax, Experian, and TransUnion—allow you to dispute inaccuracies, which can lead to score improvements.

Utilizing credit-building products, such as secured credit cards or credit-builder loans, can also be advantageous in elevating your credit score. These tools encourage responsible credit behaviors and can help establish or rebuild your credit history. By applying these actionable strategies, anyone can work towards improving their credit score, thus paving the way for better financial opportunities.

Common Myths About Credit Scores

Credit scores are often the subject of numerous myths and misconceptions that can steer individuals in the wrong direction regarding their financial management. One prevalent myth is the belief that checking your own credit score can negatively impact it. In reality, when you check your own score, it constitutes a “soft inquiry,” which does not affect your credit rating. Understanding this distinction is crucial, as regularly monitoring your credit score can help you stay informed about your financial health and identify areas for improvement without any detrimental effects.

Another common misconception is that carrying a balance on your credit card is necessary to build credit. Many individuals are misled into thinking that having an outstanding balance proves responsible credit usage. However, this is false; the credit scoring models favor on-time payments and credit utilization ratios rather than the act of maintaining a balance. In fact, consistently paying off your credit card in full can enhance your credit score by demonstrating your ability to manage your finances effectively.

Additionally, some individuals believe that older credit accounts automatically lead to higher credit scores. While the length of credit history does play a role in determining a credit score, it is not the sole factor. Timely payments, credit mix, and overall utilization also significantly impact scores. Therefore, it is essential to focus not just on the age of credit accounts but rather on maintaining a healthy credit profile.

Moreover, the myth that closing old credit accounts will improve your credit score persists among many consumers. This practice can actually have an opposite effect, as it can reduce your average account age and increase your credit utilization ratio. Therefore, understanding the truths behind these common myths can empower consumers to make informed decisions about their credit management and ultimately facilitate a more favorable financial future.